Third quarter results and commentary from Europe’s major airline groups illustrate the tighter markets in which they are operating in as softer yields and the sharp decline in air cargo demand curb profits for airlines in the region.

Third-quarter results and commentary from Europe’s major airline groups illustrate the tighter markets in which they are operating as softer yields, higher fuel costs and the sharp decline in air cargo demand curb profits in the region.

While at a headline level the past few years have been the most prosperous for the European airline industry in terms of financial returns, at an airline level the picture has been far more mixed. The bulk of the profits have centred around a few major operating groups and carriers. The continued challenges for other carriers have been evident, in the the past year in particular, amid a string of airline failures in the region.

The third quarter of the calendar year – the most profitable for European carriers – showed signs of the more challenging market conditions.

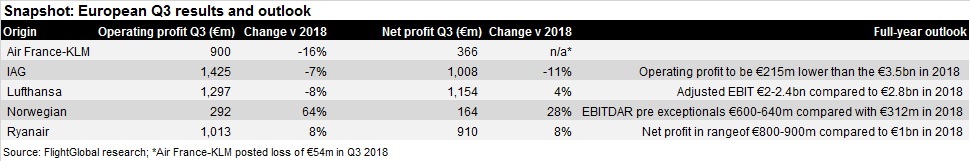

Lufthansa Group released its third-quarter financial results today and joined IAG and Air France-KLM in reporting strong, but slightly lower, operating profits for the period.

The German airline group posted an adjusted EBIT of €1.3 billion ($1.4 billion) for the third quarter of 2019, down on the €1.4 billion recorded for the same period last year. It described this as “a sound business performance” given the backdrop of a €171 million increase in its fuel costs for the period.

It points to continued strong business on North Atlantic routes, as well as reduced unit costs at its network airlines unit – which includes Austrian Airlines and Swissair alongside Lufthansa.

The group is retaining its tighter grip on capacity, noting that its network airlines will growth “only moderately” this winter, while budget unit Eurowings will reduce its capacity. The latter it hopes will return to profit by 2021.

“In taking these actions, the Lufthansa Group is responding to the continued pricing pressures in Europe, which are further intensified by a general slowdown in the global economy,” Lufthansa says.

The group is also accelerating restructuring efforts at its cargo division and subsidiaries Austrian Airlines and Brussels Airlines amid pressure on earnings, particularly in Europe, and increased fuel costs.

“In an increasingly challenging market environment, it is more vital than ever that we consistently take every action within our influence and further reduce our costs,” says Lufthansa chief financial officer Ulrik Svensson. “We expect all group companies to make their contribution here. And to these ends, we have resolved several further measures to improve the performance of our only modestly profitable and even loss-making companies.”

Notably Lufthansa stuck to its full-year profits expectations for 2019 – an adjusted EBIT target of €2-2.4 billion. That compares with an adjusted EBIT of €2.84 billion in 2018.

AIR FRANCE-KLM, IAG FEEL THE PINCH

A week earlier, Air France-KLM had posted an operating profit of €900 million for the July-September period. That marked a 16% decline from the same quarter in 2018.

While the SkyTeam carrier was still able to report improving load factors on passenger growth of 2%, the group’s unit revenue dipped 0.6%. That is a trend it expects to persist into the fourth quarter.

Long-haul bookings for November to March are slightly ahead of a year ago, although the weakness in unit revenue is predicted to continue – along with higher fuel costs. Across the full year 2019, the group expects to spend €5.5 billion on jet fuel, a €600 million increase from last year.

Though European carriers are less exposed to the air cargo business than those in some other regions, the dramatic collapse in air cargo demand – September figures released today by IATA show air freight volumes down for an 11th consecutive month – is also impacting European carriers.

Air France-KLM was also hit by stagnation in cargo earnings as a result of global trade tensions. “Air freight capacity is for another quarter significantly higher than the demand development, putting pressure on load factor and yield,” it notes.

British Airways and Iberia parent IAG also reported reduced operating performance for the third quarter, posting a profit of €1.42 billion before exceptional items, compared with the previous figure of €1.53 billion.

It cited the fallout from September strike action at BA – as well as threatened strikes by London Heathrow staff – as having an adverse impact of €155 million on operating profit.

Passenger unit revenues slipped by 1.1% at constant currency while non-fuel unit costs rose by the same proportion.

Operating profit before exceptionals for the first nine months was €2.52 billion, down by €250 million, partly owing to the “heavily impacted” third quarter.

IAG says it expects its full-year operating profit to be €215 million lower than the previous figure of €3.48 billion.

The group too felt the impact of the deteriorating air freight market. Cargo revenue decreased 2.6%, which represented a decrease of 5.0% at constant currency, reflecting the weak market conditions seen in air freight and global trade.

RYANAIR CAUTIOUSLY POSITIVE ON FARES

Outside the major network carrier groups, Ryanair results for the six months ending 30 September illustrated the challenging fare environment – though it sees some improvement for the second half.

Ryanair turned in a flat half-year net profit of $1.15 billion and says it remains “cautious” for the second half. Fares over the first half were 5% lower, which Ryanair attributes to weak UK demand and overcapacity in Austria and Germany.

Although it predicts that full-year passenger numbers will rise by 8% to 153 million, with a “slightly better” fare environment than the previous winter, the situation “remains sensitive”.

Ryanair expects its fuel expenditure to rise by €450 million while unit costs, outside of fuel, increases by 2%.

It has tightened its full-year net profits forecast range from forecast to €800-900 million – but that would be down from its 2018-19 full-year profit of just over €1 billion.

Finnair observed lower demand on its Asian network during the third quarter, particularly on its route to Hong Kong, which has been experiencing waves of anti-government protests that have intensified since mid-year.

But the quarter appears to have broadly met forecasts, with a decline in comparable operating profit to just under €101 million ($113 million) in the three months to 30 September. Revenue rose nearly 8% to €870 million.

Finnair says demand from Europe to Asian destinations “softened” during the quarter, especially to Hong Kong, despite the city being a focus of capacity growth – along with Japanese routes – over the period.

Chief executive Topi Manner says: “We see a shift in operating environment where global uncertainties have translated into slower economic growth.”

Weaker freight demand has “significantly” pushed down yields in the cargo market, although Finnair says its cargo market share grew slightly over the quarter.

NORWEGIAN PRESSURE REMAINS DESPITE GAINS

There was more positive news for Norwegian, which turned in its strongest third-quarter profit performance. It reported a 64% rise in third-quarter operating profit, to NKr2.97 billion ($326 million), after slowing capacity growth in the period as part of a concerted strategy by the loss-making carrier to reach profitability.

The airline increased capacity by just 3%, compared with 8% during the third quarter of 2018 and a 48% hike during last year’s second quarter.

“Norwegian’s key priority is returning to profitability through a series of measures, including an optimised route and base portfolio and an extensive cost-reduction programme,” the airline says.

Its year-to-date operating profit stands at NKr2.13 billion, compared with a loss of NKr258 million across the same period last year.

But a reminder of the scale of the Scandinavian carrier’s challenges came as its share price dropped by around 10% after the airline subsequently on 6 November revealed it was seeking additional funding from investors, through a convertible bond issue and a release of new shares.

Norwegian says the transactions leave the airline “fully funded” through 2020 “and beyond”, based on its current business plan.

Newly appointed chief executive Geir Karlsen says that, while the airline is seeing results from efficiency measures, its liquidity has been hit by various factors. These include the engine issues on its Boeing 787s, the grounding of the 737 Max, and reduction in credit-card acquirer capacity.

“The actions we are now taking are necessary to create financial headroom to make sure that we have sufficient liquidity as we enter the next chapter of Norwegian,” says Karlsen.