IATA expects the upturn of the business cycle and slightly lower oil prices to help fuel improved profits for airlines in 2014, even if its sees slower progress this year than it first envisaged.

The airline body anticipates a collective industry profit of $16.4 billion in 2014 - a profit second only to the $19.2 billion the industry made in 2010.

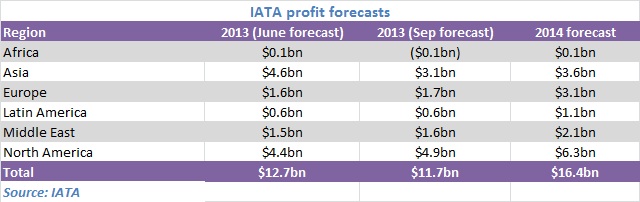

But while its profits projection of $11.7 billion for this year is $4 billion higher than the 2012 figure, it has does represent a scaling back of the figure it forecast three months ago by $1 billion.

"That is because the industry situation is not improving as quickly as we expected," explains IATA director general Tony Tyler. IATA expects revenues to reach $708 billion this year on passenger growth of 5%. While this marks steady traffic growth,Tyler describes it as "slightly disappointing" given it was projecting passenger traffic up 5.3%. He points to weakness in some key emerging markets for the lower growth rate.

"The optimism is on the passenger side of the business, not cargo," adds Tyler. IATA has further trimmed to its projection for air cargo growth to just under 1%. "The market is flat and because the supply side is driven by [belly freight in] passenger demand, cargo yields are down 4.9% this year," he says. This is even deeper than the 2% decline IATA had been projecting.

Both the struggling air cargo and slowing emerging markets are particularly hard felt by Asia-Pacific operators. Unsurprisingly then IATA has cut its profits forecast for the region by $1.5 billion to $3.1 billion. "Asia-Pacific stands out as the region facing the most difficulties," says IATA chief economist Brian Pearce. "That reflects us having seen a number of key emerging markets slowing down and the weakness of the cargo market." Pearce points to the drop in demand in India and adds that while the slow down in China hasn't affected domestic demand, it has had an impact on international travel and cargo.

"For next year its more of the same," he adds. "We see a slightly better position for international trade. Much of the growth is coming from the developed economies. We expect some growth in cargo volumes and we are not expecting cargo yields to fall so much." That means IATA is projecting muted growth of around $500 million for Asia Pacific to $3.6 billion.

By contrast IATA continues to strengthen its outlook for the mature markets of North America and Europe. It has added $500 million to its profit outlook for North American carriers this year and now envisages it as the most profitable region this year contributing nearly half the industry profit. IATA continues to cite consolidation and international joint ventures as driving the more profitable performance, together with the improving US economy. It sees this improvement continuing in 2014 as profits reach $6.3 billion.

Likewise profits among European carriers are now forecast $100 million higher than three months ago to reach $1.7 billion given improving long-haul markets and the economic stabilisation of the eurozone. While the profit is relatively small it marks an improvement on the loss IATA originally projected for European carriers this year. IATA expects a further improvement in European airlines profits in 2014 to $3.1 billion.

Middle East carrier profits are projected to reach their highest level at $2.1 billion in 2014.

The improved profits outlook for 2014 is off the back of a rise in revenues to $743 billion, driving by a 5.8% projected increase in passenger traffic and return to growth in cargo traffic. This reflects the improved economic climate - global GDP growth of 2.7% expected - especially among the developed economies. IATA is also anticipating lower oil prices. It sees the price Brent crude oil barrel price falling from $109 this year to averaging $105 in 2014.

But the one metric where IATA sees no improvement in 2014 is yields. "We don't see any good news on passenger yields," says Tyler. IATA expects passenger yields to be running fractionally down in 2014. "That's because costs are coming down," explains Pearce. "Airlines have better control of unit costs and the oil price is coming down, and in the competitive market that airlines operates, these lower costs get passed onto the consumer."

Source: Cirium Dashboard