The icy relationship between two bedrock members of the Oneworld alliance appears to have thawed, with Qantas and Cathay Pacific to start codesharing on each other’s services from the start of the northern winter season.

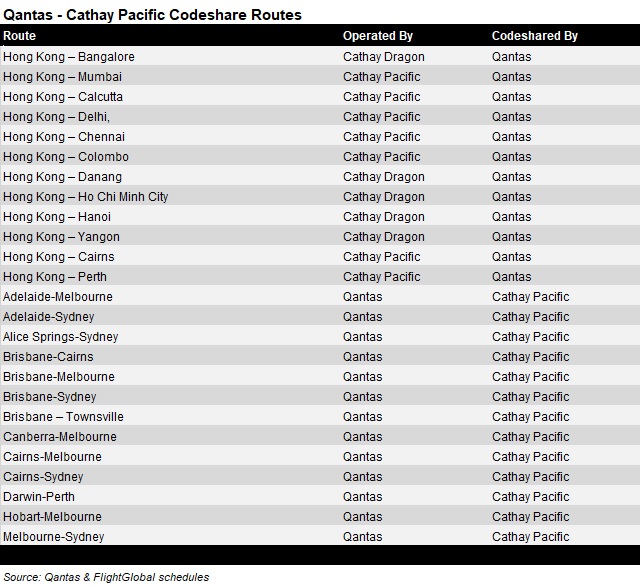

Under the deal, Qantas will only place its code on two Hong Kong-Australia routes – from Perth and Cairns – and on 10 routes operated by Cathay Pacific and Cathay Dragon from Hong Kong to India, Sri Lanka, Vietnam and Myanmar.

FlightGlobal schedules data shows that none of the destinations that Qantas will codeshare on are new to the Qantas network, with a number served through transfers at Singapore, Bangkok or Hong Kong with other partner carriers, such as Jetstar Asia, Jet Airways and SriLankan Airlines.

Cathay, meanwhile, will add Townsville, Alice Springs, Canberra, Darwin and Hobart to its network, while also opening up additional connecting opportunities through Sydney, Melbourne and Adelaide.

It seems unlikely that the codeshare will evolve further in the near term. Given the concentration on Australia-Hong Kong routes, it seems that regulators would likely block any attempt by the carriers to codeshare on their overlapping routes. Schedules data shows that Cathay accounts for 62% of seat capacity between Australia and Hong Kong, and Qantas 26%. Virgin Australia is in third place with 9.9%, while Hong Kong Airlines will cede its 2.2% share by the end of the year as it exits the Australian market.

Notably, the codeshare does not extend to Cathay’s extensive pan-China network. Instead, Qantas has a joint venture with China Eastern Airlines to handle that traffic, in addition to its own services to Beijing and Shanghai. Qantas also has a separate codeshare deal with China Southern covering most of that carrier’s services between Australia and Guangzhou.

The tie-up with Cathay bears some similarities to the one with Star Alliance carrier Air New Zealand that will also commence at the start of the northern winter season. That will see the two carriers codeshare on each other’s domestic services, but strictly avoids the transtasman market, where the two carriers are dominant players.

NOW, PLAY NICELY TOGETHER

Although both carriers are founding members of Oneworld, they have had a long history of competition and bad blood between.

For the best part of 50 years, Cathay has competed against Qantas on the Australia-Europe market, by attracting passengers to fly via its Hong Kong hub. The two competed head on between 2004 and 2012 when Qantas operated daily Sydney-Hong Kong-London Heathrow services.

Relations between them were strained even further in 2012 when Qantas announced plans to start Jetstar Hong Kong in association with China Eastern Airlines. Cathay was a vocal opponent to the proposed airline gaining a license, which was ultimately blocked and saw Qantas to walk away from the plan in August 2015.

Nonetheless, the Australian carrier has been growing its capacity to Hong Kong, and in association with that the number of codeshare connections it offers from Chep Lap Kok. Nowadays, those include routes to India with Jet Airways, Paris Charles de Gaulle with Air France, Danang and Hanoi with Jetstar Pacific, Tel Aviv with El Al and Colombo with SriLankan.

NETWORKING VIRTUALLY

In many ways, the Cathay codeshare is just a continuation of Qantas’s asset-light approach to expanding its international network as it plays to its strengths in the high-end leisure and corporate markets.

Indeed, since it ended its Perth-Hong Kong flights in 2013, the Australian carrier has lacked a convenient service linking the West Australlian capital with Hong Kong, which is a major transit point into mainland China, and has strong business links.

While there is likely less corporate traffic from Cairns, the importance of the city as a major gateway to North Queensland and the Great Barrier Reef meant that it, too, was a white-spot in Qantas’s Asia network – with the exception of Jetstar’s flights to Tokyo and Osaka.

Even if it were seeking to launch services from the two Australian cities to Hong Kong on its own metal, Qantas simply does not have enough aircraft in its fleet to do so. The rebuilding of its Singapore hub since it re-started Sydney-Singapore-London services in March, and redeployment of widebodies onto the Tasman, leaves its Airbus A330 fleet running at maximum capacity.

Its other international aircraft, 787s and A380s, are also running at high utilisations, while the airline is accelerating the retirement of its remaining 747s as more 787s roll in.

So perhaps rather than a complete thaw of a frosty relations, a friendship of convenience has been born.

Source: Cirium Dashboard