Airbus and Boeing had best not approach the chief executive of aircraft lessor AerCap seeking to sell next-generation clean-sheet narrowbody jets.

At least not anytime soon.

AerCap CEO Aengus Kelly says he is not interested in being pitched A320 and 737 replacements while Airbus and Boeing are still struggling to overcome issues dogging their existing aircraft.

”Make sure the door doesn’t hit you on the way out,” is how Kelly summarises his likely response to any such proposals from Airbus or Boeing.

“Please don’t come in here and tell me you are going to have another swing. I want the stuff you’ve built to work better,” Kelly adds, speaking during AerCap’s first-quarter earnings call on 30 April.

He made the comments when asked by BofA Securities managing director of aerospace and defence Ron Epstein if he thinks “the 737 needs to be replaced”.

“No. It does not. What’s the point?” Kelly says.

He calls Boeing’s Max 8 “a good airplane” and says the long-delayed Max 7 and Max 10, once certificated, will help the US manufacturer better compete with Airbus’s A320neo family of jets.

Problem is, those aircraft are not as trouble-free as the aircraft they are replacing.

“You’ve got to get the existing aircraft you are building more reliable, more durable in service – that’s all I care about,” Kelly says. “The ones you’ve built do not have the same reliability and durability of your previous generation.”

BofA’s Epstein says he views Kelly’s comments as reflecting the CEO’s frustration about various problems with new-generation jets and their engines, and about supply chain and production constraints.

Kelly “just wants stuff that works”, Epstein says.

New-generation jets from Airbus and Boeing have suffered reliability problems, including those due to problems with the CFM International Leaps and Pratt & Whitney (P&W) PW1000Gs geared turbofans (GTFs) that power them.

GTFs have proved particularly troublesome due to an ongoing, yearslong recall for inspections and replacement of metallic components that might be defective and could fail early. The problem, due to defects involving a manufacturing process using powder metal, have left roughly one-third of the global GTF-powered fleet grounded at any given time.

GTF variants power Embraer E-Jet E2s, A220s and are one of two power options for A320neo-family jets.

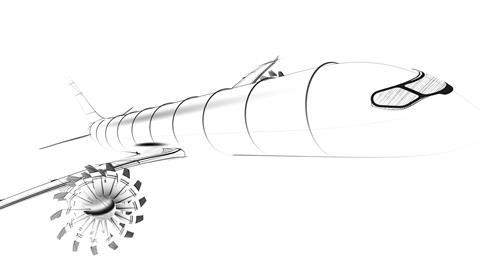

CFM has also suffered durability issues with its Leap turbofans, particularly those operated in dusty conditions. The company has rolled out durability fixes, including new turbine blades, and insists reliability is improving. Leaps power the 737 Max and are the second A320neo engine option.

On the plus side, Leaps and GTFs burn significantly less fuel than earlier-generation engines.

Some insiders say the new engines, due to burning hotter and at higher pressure, will never be as reliable as earlier engines such as CFM56s, which are renowned for trouble-free longevity.

Lessors and airlines have also been disappointed by ongoing aircraft delivery delays, and Boeing has been beset by quality shortcomings.

Analysts generally expect Airbus and Boeing will bring clean-sheet narrowbody jets to market in the mid-2030s.

The manufacturers have said those aircraft must be significantly more fuel efficient than current types. They are now working, alongside engine makers, on technologies intended to reduce fuel burn.

For instance, CFM is developing an open-rotor engine it says could run on 20% less fuel than today’s narrowbody engines, while P&W has talked of a 25% efficient boost with the next generation of its GTF. Airbus and Boeing are also studying thinner, more efficient wings.