Ahead of this year’s Paris air show, which opens next week, it is increasingly clear that the two primary producers of turbofans for narrowbody passenger jets are following divergent paths in developing engines for next-generation aircraft expected to reach the market in the 2030s.

Much is at stake, as Airbus and Boeing want their next narrowbodies to be as much as 25% more fuel efficient than today’s models. Some of that improvement will surely come from airframe design and other non-engine advances, but engine manufacturers will need to carry much, if not most, of the weight.

Airbus and Boeing might still be a decade from finalising their requirements, but CFM International and competitor Pratt & Whitney (P&W) have little time to waste. They face a decision with immense ramifications: dive into developing a radically new powerplant, or invest to update and improve the conventional turbofan architecture.

Influencing that decision is the imperative – hit home by ongoing maintenance issues – that future engines not suffer durability problems such as those affecting today’s narrowbody turbofans.

Speaking in recent weeks, executives from P&W and GE Aerospace, which co-owns CFM in partnership with Safran Aircraft Engines, left no doubt they have chosen paths that could not be more different.

Connecticut-based P&W, a division of RTX, is betting that a more-durable and more-efficient update to its PW1000G geared turbofan (GTF) is the best engine for future narrowbodies. P&W intends to equip such an engine with components made from advanced materials including ceramic-matrix composites (CMCs).

“The architecture that we have with the GTF is the architecture that will be used on next-gen single aisle,” P&W commercial engines president Rick Deurloo said in May at the company’s sprawling new manufacturing facility in Asheville, North Carolina. “We will have a gen-two GTF that will have composite fan blades, CMCs – maybe hybrid-electric.”

“It’s going to be a traditionally mounted installation,” Deurloo adds.

Ohio-based GE, meanwhile, has committed to and thrown its vast resources behind CFM’s Revolutionary Innovation for Sustainable Engines (RISE) programme to develop an open-fan engine demonstrator. CFM says the design can be 20% more efficient than today’s turbofans.

“The RISE programme [is] the largest demonstrator programme our company has ever embarked upon,” GE future of flight engineering head Arjan Hegeman said several weeks ago. He spoke at the company’s massive Research Center near Albany, a facility steeped in GE history that has long served as technology-development hub.

GE executives decline to say if they are hedging their bet by also pursuing development of a future traditional turbofan. But they insist technologies they are pursuing under RISE would be applicable to other powerplant designs.

Just which path – traditional or novel, or both – ultimately wins out depends to a large degree on the preferences of Airbus, Boeing and perhaps another aircraft manufacturer. A decision is likely years away, though airframers are involved in the engine question.

Airbus will help CFM with the work of flight testing the RISE open-fan demonstrator. Frank Haselbach, Airbus senior vice-president of propulsion integration, said in March that if the open-rotor design works, “it will be very, very powerful” and offer the “biggest potential” of any future propulsion choice.

Some Boeing executives have also expressed interest in the open-fan architecture, and Boeing is helping GE flight test a hybrid-electric demonstrator that is part of the larger RISE effort.

However, Stan Deal, former chief executive of Boeing Commercial Airplanes, expressed scepticism in 2023 that CFM can really get 20% better efficiency out of RISE. Some analysts also question if Airbus, and particularly Boeing, which is reeling from recent quality problems, will be open to the degree of risk posed by a novel engine like an open fan.

OPPOSITE PATHS

During a recent tour of GE’s New York Research Center, executives stressed the strength of the company’s research division, including its advanced composite-material technologies, saying those capabilities position it to ensure the open fan succeeds.

P&W, meanwhile, expresses confidence that aircraft manufacturers and operators, still coping with durability problems afflicting current-generation turbofans, will shy from backing technologies and designs not yet proven in airline operations.

P&W’s GTF, which powers Embraer E-Jet E2s, A220s and is among two A320neo-family engine options, has been particularly affected by reliability problems. Defects in metallic engine parts caused by manufacturing issues involving powdered metal prompted an ongoing global GTF recall. As a result, airlines have grounded hundreds of jets for early inspections and parts replacements.

CFM’s competing Leap has suffered durability troubles of its own, though not as far-reaching, including issues linked to operating in hot and dusty environments. GE has responded by redesigning parts including turbine blades and fuel nozzles. Leaps are the sole engine powering 737 Max and are the second A320neo engine option.

Many aerospace analysts believe that neither Leaps nor GTFs will ever be as reliable as the engines they succeeded. The manufacturers, in search of improved fuel efficiency, designed the new powerplants to run significantly hotter and at higher pressures than older models – conditions that can cause parts to wear out faster, experts say.

GE and P&W insist they are addressing the problems.

“We’ve learned our lessons, and we’re making sure that we have the configuration that will be stable and one that we can build upon,” P&W’s Deurloo says.

Executives point to P&W’s new Asheville manufacturing site as evidence of its commitment to improving the durability of both current and future engines, and to addressing supply chain problems.

The company has committed to invest nearly $1 billion in the 111,500sq m (1.2 million sq ft) Asheville site, including $285 million on an in-progress project to build an “advanced casting foundry” expected to come online in 2028. The Asheville facility produces high-pressure turbine blades and vanes for the A320neo’s PW1100Gs and A220’s PW1500Gs. The blades and vanes are produced from a high-nickel alloy and finished with a ceramic coating for improved durability.

P&W site manager Dan Field describes the site, which opened in November 2022, as exemplifying the firm’s commitment to bolstering quality and streamlining its supply chain. That chain involves suppliers in the Midwest shipping castings to P&W, which then trucks the castings “back and forth” between Connecticut, New York and Pennsylvania manufacturing sites – with materials travelling some 2,500 miles in the process.

“That makes [for] a really complicated and difficult-to-manage value stream that isn’t particularly lean,” Field says. “The vision behind this facility is to get all of those operations inside one building”, with ingot coming in one side and finished components exiting the other.

Keeping all that work under one roof in Asheville better positions P&W to monitor production and quality, says Field, noting the company uses advanced digital tracking, with data flowing “back and forth, from what’s happening on the shop floor to… how the product is designed and how it’s performing in the engine”.

The facility is ramping up production and provides “supplemental capacity” to the company’s other supply systems, which will continue operating, he adds.

“We’re working on a full ramp to rate,” Field says. “This year we are going to do about 200,000 units. We have the capability and capacity in our plan to do about 300,000 units over the coming years.”

P&W needs that capacity to support accelerated GTF production and to respond to the recall, which has led to a spike in demand for replacement components, pressuring already strained production systems. “Today our biggest challenge… is around the [aircraft on ground] situation,” says P&W’s Deurloo.

He notes P&W has responded by ramping up its maintenance capabilities, with that capacity up 35% year on year in the first quarter of 2025. P&W also insists its recovery plan is on track.

“Everything in our forecasts and our estimates around fallout… it’s actually maybe even slightly better than what we anticipated. We are seeing everything from the fleet-management plan coming through,” Deurloo says.

FOCUS ON DURABILITY

The engine problems have been incredibly disruptive. But P&W says product improvements developed in response to the issues will benefit its development of future turbofans.

Improvements include a programme started this year that involves P&W, during maintenance visits, equipping GTFs with improved hot section parts. The update extends the powerplants’ maintenance interval by 40% compared to the otherwise “best” GTF configuration; in other words, compared to the configuration of engines delivered in the last several years, which are already more durable than GTFs delivered eight or nine years ago to customers like JetBlue Airways and Spirit Airlines, says Deurloo. Those carriers have suffered significant operational disruptions due GTF durability shortfalls.

“We are putting this into the MRO first… We are focusing on the flying fleet, to help them,” Deurloo adds.

Separately, in February the Federal Aviation Administration certificated P&W’s first major PW1100G upgrade, the GTF Advantage.

“We are the only one right now with the next evolution of an engine, with the Advantage,” says Deurloo.

The Advantage provides 4-8% more thrust (allowing for more range or payload) and, says Deurloo, “much better time on wing” thanks to additional cooling and use of components like “double-walled vanes” and other “full-life parts” – as opposed to less-durable parts found on earlier-generation GTFs.

“We are going to have a state-of-the-art hot section. New cooling holes. New coatings,” RTX CEO Chris Calio added on 28 May. “Additional cooling air going through the engine – that’s how we are able to get the additional thrust, by opening up the [low-pressure compressor].”

Additional cooling will have a “minimal” negative impact on fuel efficiency, but durability gains make the Advantage a “no brainer”, says Deurloo.

“This engine is… first-in-class as far as fuel burn,” he says. “If I could go back in time and give up a little of all this fuel burn… and get a little bit more durability out of it, there’s not a customer in the world that wouldn’t make that trade.”

P&W recently completed GTF Advantage high-altitude testing out of La Paz, Bolivia, Deurloo says. “Everything is going exceptionally well on the flight-test programme… We feel incredibly good [about] what we’re seeing out of that engine”.

The company intends to begin delivering GTF Advantages to Airbus this year and for the powerplants to enter service on new A320neo-family jets in 2026. It plans to initially produce Advantages at a relatively slow rate – perhaps six to eight monthly – and to also produce baseline GTFs until cutting solely to Advantage production in the first half of 2028. “We want to make sure our production system lines up with our delivery system,” Deurloo says.

P&W has also rolled out a maintenance programme to install Advantage-specific hot section components into in-service PW1100Gs, aiming to have that upgrade available next year. “We’re taking that hot section out of the Advantage and bringing it right back into the base engine, including the combustor and the panels,” says Deurloo.

“You can get about 90% of the durability improvements from about 30 to 35 of the parts,” adds Calio.

Executives say such incremental improvements will continue and that P&W will also focus on developing composite components, including CMCs – which will find their way into future GTF variants.

“If the earliest [that airframers] launch a programme like this… is in 2035, we’re going to have 300 million hours flown on the GTF architecture,” says Deurloo. “We’re going have more and more learnings that we’re going to bring into that gen-two GTF.”

“I think it’s a much-lower-risk proposition,” he adds. “We have a good roadmap to get us to where we think we’re going to be incredibly competitive, and I think we’re going to be at a very low risk.”

GE CROSSING ’VALLEY OF DEATH’

GE executives see things differently, stressing their firm’s history of pushing through technological barriers and bringing innovative designs to market.

“GE Aerospace as a company… has figured out how to defeat the so-called Valley of Death”, says GE senior executive director of research Joe Vinciquerra.

”Valley of Death” is a metaphor for the product development period between technology demonstration and early scale production. Carrying technologies across the so-called valley is notoriously difficult.

“There is a huge divide between [demonstration] and actually realising a product and fully industrialising it,” Vinciquerra says. “We… spend a lot of time working with academia, working with government, science and technology agencies, national labs, other partners, to really incubate and germinate new ideas.”

Executives point to the Research Center, which encompasses about 30 laboratories covering 32,500sq m, as a symbol of GE’s technological prowess. Some 1,000 employees, including 750 researchers, work there, focusing on developing advanced materials, manufacturing technologies and aero, thermal, mechanical, digital and electrical systems. The site’s roots reach back to GE’s early days of pioneering technologies like television and radio broadcast.

More recently, workers at the Research Center helped develop 3-D printed components such as fuel nozzles found in Leap turbofans, and CMC components used in engine hot sections. Such CMCs include Leap stage-one shrouds and GE9X shrouds, stage-one and stage-two nozzles and inner and outer liners.

The CMCs are produced from a silicon-carbide-fibre material – with nearly 1.5 million fibres per square inch in some components – and coated with boron nitride, which helps maintain integrity.

They are “exceptionally lightweight… a third the density of nickel-based super alloys… and they can run hotter uncooled, a huge breakthrough in terms of efficiency”, says Vinciquerra.

Nickel-based alloys from which turbofan hot-section components are often made start to lose strength rapidly at temperatures exceeding about 1,093°C (2,000°F), GE says. And while CMC components are not quite as strong as nickel alloys at cooler temperatures, they retain more strength at hotter temperatures, including up to about 1,343°C, enabling engineers to design engines that run hotter, resulting in improved thermal efficiency and, hence, better gas mileage.

Staff at GE’s Research Center also helped develop the composite fan blades found in the company’s widebody aircraft engines.

GE started developing such blades decades ago, installing them on the GE36 open-fan demonstrator it developed and flight tested (including on a 727 and MD-80) in the 1980s. That project never resulted in a production engine, but GE brought composite fan blades to prime time in the mid-1990s in the GE90 that powers 777s. It then equipped the GEnx, which powers 787s and 747-8s, and its newest and most-powerful-ever-commercial turbofan, the 777X’s GE9X, with composite blades. The company says mastering the “art and science” of producing composite blades at high-yield production rates is among its toughest challenges.

Executives say those technologies and others, including hybrid-electric systems, will fuel GE’s ability alongside Safran to develop a viable open-fan demonstrator under CRM’s RISE programme, which the engine maker launched in 2021. They say an open fan can be quieter and 20% more efficient than CFM’s Leap.

HIGH HOPES; STILL A DEMONSTRATOR

RISE is not yet a product offered for sale. But executives express confidence it will be, saying significant analysis by GE and Safran point to the project’s success.

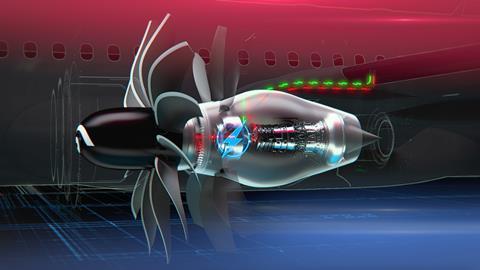

Open-fan engines offer the promise of significantly improved fuel efficiency because they allow engineers to increase the fan’s size – and hence increase the bypass ratio, which is key to efficiency – without incurring weight and drag penalties from ducts and other structures that surround traditional turbofans. Because of those penalties, developing conventional turbofans with significantly larger fans is impractical.

GE’s 1980s demonstrator, with two counter-rotating fans, proved overly complicated and loud, and the programme lost steam amid declining fuel prices, never advancing past demonstrations.

“The open fan itself still had some issues that needed to be resolved over decades,” says GE’s Hegeman. But the powerplant “proved out composite blades”.

The RISE demonstrator benefits from GE’s past learnings and technological developments in the fields of materials, acoustics, computer simulations and electric systems. The demonstrator will have a single fan with variable-pitch composite blades sitting forward of guide vanes. CFM will also give it a “compact core” containing CMC components that will burn hotter and at higher pressures than traditional turbofan cores.

A megawatt-class hybrid-electric system is envisioned as powering the RISE open fan during some phases of flight. Toward that end, GE is now developing a hybrid-electric demonstrator using a Passport turbofan in partnership with NASA. It aims to test fly that hybrid system on a Saab 340B turboprop with Boeing’s assistance. Safran, meanwhile, has conducted wind-tunnel tests of a subscale open-fan prototype.

Should the RISE demonstrator transition into a full development programme, it would cost around €10 billion ($11.4 billion) in total – split between GE and Safran – to bring it into production, Safran chief executive Olivier Andries has said.

“It’s not a single… demonstrator,” Hegeman says of the project. “There are many [technologies] and they all build on top of each other, and… accumulate to this final open-fan architecture.”

The timeline calls for CFM to flight test the demonstrator later this decade using an A380 in partnership with Airbus. Development is envisioned as wrapping up in the 2030s as Airbus and Boeing develop their next narrowbodies.

About one-third of employees at the New York Research Center are focused on RISE projects, says GE’s Vinciquerra.

DURABILITY CENTRE STAGE

GE has largely completed RISE component-level testing and recently wrapped up “turbine technology testing”, which confirmed “that our models were right and that the hardware is delivering what we want”, says Hegeman. “Then, we ran 3,000 endurance cycles. We’ve never done that level of endurance testing this early in any programme ever.”

“What’s next is, we start testing… very large subsections of the engine,” he adds.

GE researchers and engineers are focused as intently on the open fan’s durability as on proving the technology works, Hegeman says. “This whole understanding and appreciation of engine durability, and the impact on overall product value to our customers, is now ingrained in this whole cycle of… development.”

GE chief technology officer Mohamed Ali says RISE’s 20% efficiency goal would have been impossible to achieve had GE not spent decades developing technologies like composite fan blades.

“Each generation of products is building on the previous one, adding new learnings and adding more innovations, with the magic started at the Research Center,” he says. “This is what enables confidence in the… 20% fuel improvement, with reliability and durability meeting or exceeding the customer expectations.”