The number of commercial aircraft grounded due to Pratt & Whitney’s (P&W) recall of PW1000-series turbofans appears to have declined slightly in recent months, but the share of grounded jets remains roughly unchanged at close to 30% of the fleet.

Meanwhile, the company is moving forward with several upgrades it says will help address durability problems that have plagued the new, more-efficient powerplants.

Durability problems are not unique to P&W’s PW1100G geared turbofan (GTF), as competitor CFM International has also been addressing durability troubles affecting its Leap turbofans. Those issues have not left nearly as many aircraft grounded.

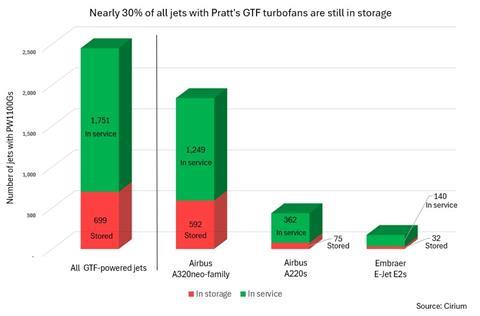

The global fleet of jets powered by the three primary models of P&W’s GTF now stands at 2,450 aircraft, up from 2,311 five months ago, an increase reflecting continued deliveries of new GTF-powered jets by Airbus and Embraer, according to fleet data provider Cirium.

Of those 2,450 aircraft, Cirium lists 699, or 28%, as in “storage”. Those include 592 A320neo-family jets with PW1100Gs, 75 PW1500G-powered A220s and 32 PW1900G-powered E-Jet E2s.

By comparison, FlightGlobal reported in February that Cirium then had tagged 739 aircraft with GTFs as being stored, representing 32% of the fleet at that time.

Cirium does not specify why aircraft are in storage. Sources say most have likely been pulled from flight duty to accommodate engine maintenance, including that associated with the GTF recall, though some of the aircraft surely down for other reasons. By comparison, fewer than 90 Airbus A320neo-family jets and Boeing 737s powered by CFM’s competing Leap turbofan are now in storage, representing 2% of that 4,090-strong fleet, Cirium data shows. While Leaps are the only power option for the 737 Max, Airbus offers Neos with Leaps or GTFs.

P&W parent RTX declines to confirm how many jets with GTFs are grounded. The company may disclose more details about the recall during its second-quarter earnings call, scheduled for 22 July.

“We are focused on returning our customers’ aircraft to service as quickly as possible and are working around the clock to support them. As MRO output is a key enabler for reducing [aircraft on ground], we’ve worked to significantly grow our MRO capabilities this year,” says RTX.

It notes expanded relationships with Delta TechOps and MTU, and the addition of maintenance providers Sanad and ITP Aero into its MRO network.

“We’re also delivering improvements in GTF durability,” RTX adds.

Connecticut-based P&W revealed the PW1000G recall several years ago after determining some components within the turbofans might be subject to early failure due to being manufactured using contaminated powdered metal. Affected components include high-pressure turbine and compressor disks, hubs and air seals, according to P&W and the Federal Aviation Administration.

Completing the recall work, which includes inspections and part replacements, has been hampered by parts and labour shortages and can therefore require the engines be removed from service for the better part of a year, RTX has said.

It expects the recalls will continue through end-2026. RTX has recently said that its recall-recovery plan remains on track, and it has noted that P&W’s maintenance capacity early this year jumped 35% year-on-year, aiding the recovery.

P&W has also loudly been promoting several design changes said to improve durability.

Notable is P&W’s introduction of the GTF Advantage, a new variant certificated by the Federal Aviation Administration in February.

Scheduled for 2026 service entry on A320neos, the Advantage will provide 4-8% more thrust and “much better time on wing” thanks to additional cooling and use of components like “double-walled vanes” and other “full-life parts”, P&W commercial engines president Rick Deurloo said in May.

Meantime, P&W this year began, during maintenance visits, installing more-durable hot-section parts into in-service GTFs – updates that will extend maintenance intervals 40% compared to GTFs delivered in recent years, according to the company.

Building on that, P&W next year plans to begin an aftermarket programme called “Hot Section Plus” that involves installing into first-generation GTFs 35 components that are unique to the GTF Advantage, giving the updated powerplants 90-95% of the Advantage’s durability gains, P&W says.

Despite the GTF recall, P&W continues landing new deals. Last month during the Paris air show, Hungary’s Wizz Air revealed ordering PW1100Gs to power another 177 of its incoming A321neos. At that time, Wizz chief executive Jozsef Varadi conceded frustration with durability problems but said Wizz’s decision looked “through the current issues”, adding, “This is a bit like a marriage – there are ups and downs”.