When a American-made reusable aircraft broke the hypersonic barrier for the first time in nearly 60-years this past December, it was not one of the aerospace industry’s prime engine makers, but a small start-up from Colorado that powered the milestone flight.

Headquartered north of Denver, Ursa Major is quietly shaking up the market for advanced propulsion. It is one of the company’s Hadley liquid rocket engines that has now twice accelerated Stratolaunch’s experimental Talon-A uncrewed aircraft to Mach 5 hypersonic flight, as revealed by the Pentagon in May.

Ursa Major chief executive Dan Jablonsky says the notion of two start-ups developing and flying a reusable hypersonic vehicle is “something that just hasn’t been done before”.

“We are, I think, a very fantastic example of venture money going into new ideas and trying new things on innovative scale and timeline for rapid iteration of designs,” says Jablonsky, who assumed the CEO role in 2024.

The Hadley powerplant is 80% comprised of 3D-printed components and comes in three different variants, including the hypersonic-capable model and another qualified for use in the vacuum of outer space.

In addition to the Talon-A project, Ursa Major is also working with Japanese reusable rocket start-up Innovative Space Carrier, with plans to launch a Hadley-powered prototype vehicle before the end of this year.

That would mark the first ever joint US-Japan commercial space launch.

At home, Ursa Major is also finding success in the defence sector, winning the type of contracts normally dominated by long-established prime manufactures.

In 2023, the company unveiled a flexible, high-rate approach to solid rocket motor (SRM) production, saying it aimed to upright a market “plagued by a broken supply chain and an overextended industrial base”.

At the time, the US domestic market for SRMs had shrunk to just two suppliers: Northrop Grumman and Aerojet Rocketdyne, with the latter having just been acquired by L3Harris that year.

Some 18 months later and Ursa Major has fully validated its SRM manufacturing process called Lynx and is working with US munitions producer Raytheon to propel new long-range missiles, including a successful test flight in March.

The start-up is also under contract with the US Navy to develop a prototype SRM for the navy’s Standard Missile programme, which includes a range of munitions used for ship-based air defence, anti-ballistic missile defence, and ship-to-ship engagements.

Jablonsky credits Ursa Major’s success to the company’s focus on the rapid integration of new ideas through the cycle of design and development.

“We developed three whole new rocket engine systems on the liquid side,” he notes. “Some of the primes haven’t developed any this century.

“That’s a quantum of speed that we’re bringing to the table in the past decade that really hasn’t existed anywhere else,” Jablonsky adds.

Other aerospace start-ups have taken a similar tack, including hypersonic developer Hermeus and would-be disruptor of the defence industry Anduril.

Part of the reason for that strategy – and its apparent success – is that the new generation of aerospace and defence start-ups do not have the endlessly deep pockets associated with their more established rivals.

“I think that forces us to innovate quicker and to be on faster timelines, because it’s a sprint to be able to prove the technology and manufacturability,” Jablonsky says.

Looking forward, Ursa Major is developing a tactical version of Hadley that will combine the long-term storable attributes of solid rocket motors with the active throttle control and extended ranges of liquid fuelled systems.

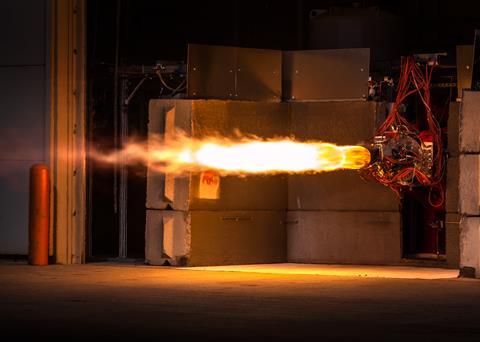

The company calls the new design Draper, and says it will eschew the use of volatile cryogenic fuels, while still being able to accelerate payloads to hypersonic speeds. In the past year, Ursa Major has test fired the Draper more than 200 times.

The new powerplant is set to make its maiden flight under a $28.5 million contract with the US Air Force Research Laboratory to develop propulsion solutions for hypersonic, responsive space and on-orbit applications.

Ursa Major is the prime contractor for that effort, integrating the flight vehicle with the Draper engine. The programme’s first flight is currently scheduled for December.

Jablonsky envisions the Draper as a significant future product line for Ursa Major, with a range of applications for hypersonic-capable platforms, including aircraft, test beds, target drones, offensive weapons, defensive interceptor missiles and propulsion upgrades to existing systems.

“It’s almost unlimited potential with the Draper hypersonic system,” he says. “Nothing else like it exists.”