Updated to reflect that 11 of Prime Air's 767s are -300ER BDSFs.

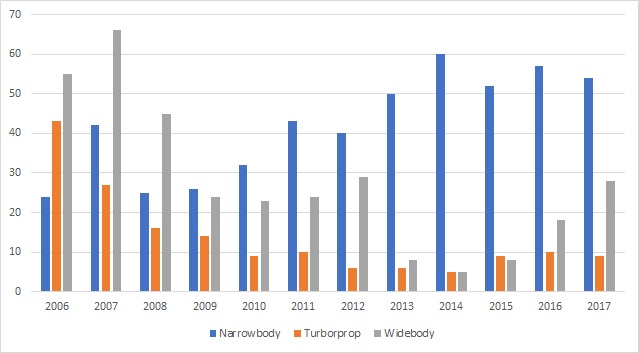

Freighter conversions rose by 7% to 91 aircraft during 2017, with widebody conversions jumping to their highest level in five years.

The year saw six more aircraft converted than in 2016, Flight Fleets Analyzer shows.

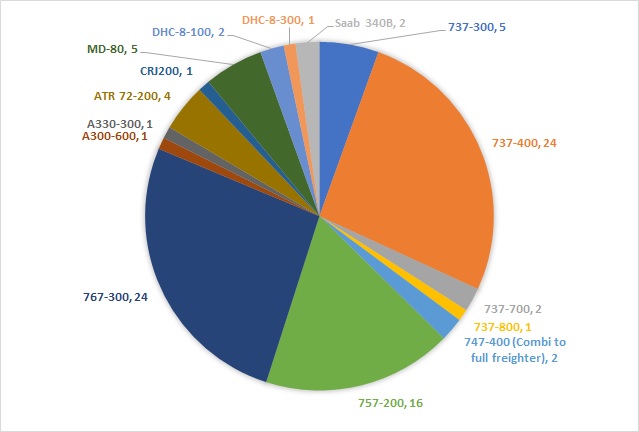

Widebody conversions rose by more than 50% to 28 aircraft during the year. Of these, 24 were Boeing 767-300s, with demand driven by Amazon's Prime Air unit, which received 16 converted 767s – five -300ER BCFs, and 11 300ER BDSFs.

In addition, Aloha Air Cargo, Amerijet International, Air Transport International, Atlas Air, Cargojet, and SF Airlines each received single converted 767-300ERs. Kalitta Air received two.

The year saw an Airbus A300-600 converted for Uni-top Airlines and the delivery of the first A330-300P2F to ASL Airlines.

A pair of Asiana Airlines 747-400 Combis were also converted to full freighters.

Cargo conversions by aircraft category

All data sourced from Flight Fleets Analyzer

Narrowbody conversions fell by three units to 54 aircraft. Here, the 737 family accounted for 32 conversions. This comprised five 737-300s, 24 737-400s, two 737-700s, and one 737-800. With feedstock for older 737 "Classics" starting to run down, conversions of 737NGs are likely to grow in the coming years.

"737 conversions held up in 2017, as this is a good freighter and there is reasonable availability," says Flight Ascend Consultancy's head of market analysis, Chris Seymour. "The main narrowbody change was that FedEx completed its 757 conversions, bringing down the 757 total."

Conversions of 757s fell to 16 from 27 in 2016, while other narrowbody conversions included a five MD-80s and a single Bombardier CRJ200.

Key recipients of modified narrowbody freighters in 2017 were ASL Airlines (six 737-400SFs), West Atlantic (four 737-400SFs), DHL (six 757-200SFs) Air, and SF Airlines (four 757-200SFs), and Aeronaves TSM (four MD-82SFs).

2017 freighter conversions by aircraft type

"This year will be good for 737 Classics and 757s, although since feedstock is running out it may be the last good year," says Seymour.

"Nonetheless, 737NGs will get more traction in 2018. While there will be more NGs and with the first A321s becoming available, the main issues here will be pricing and availability. Initial customers will mainly be lessors and Chinese operators."

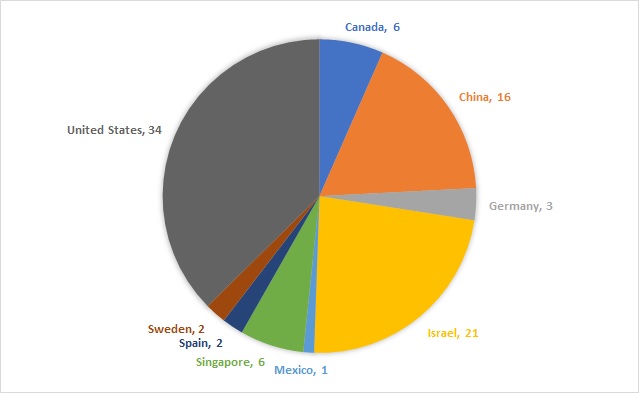

2017 freighter conversions by country

In the turboprop segment, there were nine conversions redelivered, down from 10 the previous year. These comprised four ATR 72-200s, two Dash-8 100s, one Q200, and two Saab 340Bs.

As for conversion locations, the USA led with 34, followed by Israel with 21 and China with 16. While US and Chinese conversions are dispersed geographically, Israeli conversions all take place at Tel Aviv's Ben Gurion International airport, home of conversion specialist Bedek Aviation.

Source: Cirium Dashboard