The courting of one of Europe’s perennial loss-making airlines at the same time as one of its existing European investments is struggling to keep its head above water may seem counterintuitive, but for Etihad it forms part of the continued drive to build traffic flows through Abu Dhabi.

While chief executive James Hogan rolled out a mantra of “to be the best, you don’t have to be the biggest” during the carrier’s recent high-profile new product launch in Abu Dhabi, Etihad is doing its best to make up lost ground on its Gulf rivals with its own aggressive growth. The carrier has almost doubled passenger numbers over the last five years, to 11.5 million, and is rapidly expanding its fleet.

But as the last entrant among the big-three Gulf carriers, it remains relatively small. Etihad’s group revenues of $6.1 billion place it in the lower echelons of the top 30 biggest carriers and it’s a similar story for passenger traffic as measured in RPKs. The airline’s neighbour in Dubai is already firmly established in the top 10 by both criteria.

“I think people sometimes forget we are a large airline in our own right,” says Hogan. “My core focus will always be Etihad Airways. But what was the strategy from the start, it’s been about how do we reach the markets beyond.”

That has led it to embrace a high-profile partnership strategy, investing in a number of airlines and striking codeshare pacts with many more. “The codeshare and equity alliance strategy represents 20% of our revenues,” says Hogan. It has also helped drive continued growth at its Abu Dhabi airport hub. Passenger numbers increased 12% at the airport last year, to 16.5 million, and grew another 15% in the first three months of this year.

“We have a very clear strategy on how we build the hub in Abu Dhabi, how we connect Europe with India, Southeast Asia, Australasia,” says Hogan. “The largest outbound Europe from market is Germany: Air Berlin carries 35 million passengers and if you look at the Etihad side in regard to the traffic that is coming to our system, that has exceeded our targets.

“We bring considerable access out of Southeast Asia, out of Australasia, also out of Abu Dhabi into Germany, so the traffic flows work well for both of us.”

This explains the airline’s willingness to continue to back the restructuring of the loss-making German carrier despite its failure thus far to make any inroads into stemming the losses: Air Berlin’s operating loss of €232 million ($319 million) in 2013 is only a €15 million improvement on the 2011 figure it incurred prior to Etihad buying into the airline. Such is the importance of the market, Etihad is instead redoubling its efforts to restructure the airline – and the addition of two of its executives in the airline and a new management consultancy indicates the gloves may be coming off.

If the scale of problems and work needed to turn around Air Berlin has surprised Etihad, it has not put it off. Several reinventions and numerous business plans have failed to bring profitability to Alitalia, but still the Gulf carrier is looking to invest in the Italian airline – with which it already has a codeshare relationship. The experience of Air Berlin, however, perhaps goes somewhere to explaining the apparent toughening in its terms and conditions before investing. More than three months since investment talks entered a “final phase”, they remain ongoing.

At the heart of Etihad’s strategy is access to markets and feeding traffic through the Abu Dhabi hub.

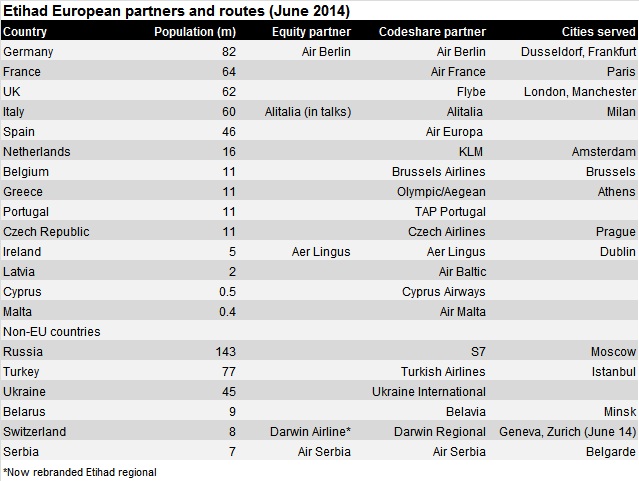

Out of the biggest EU market by population, Etihad has investments and/or strong codeshares in place with the five biggest markets: Germany, France, the UK, Italy and Spain. It serves all of them directly except Spain, where it has this year sealed a codeshare with Spanish operator Air Europa, which will launch its own flights to Abu Dhabi. Etihad’s partnership with Air France-KLM, meanwhile, also involved Etihad launching flights into Amsterdam last year.

Etihad largely keeps its own EU destinations to routes along a corridor from Dublin and the UK to Abu Dhabi, serving southwest Europe and Scandinavia largely through codeshares. While it does not yet have a direct codeshare partner in Scandinavia, it relies on its northern Europe partners to help deliver links to this region. Poland and Romania are the two largest EU countries where it does not have services or codeshare partners.

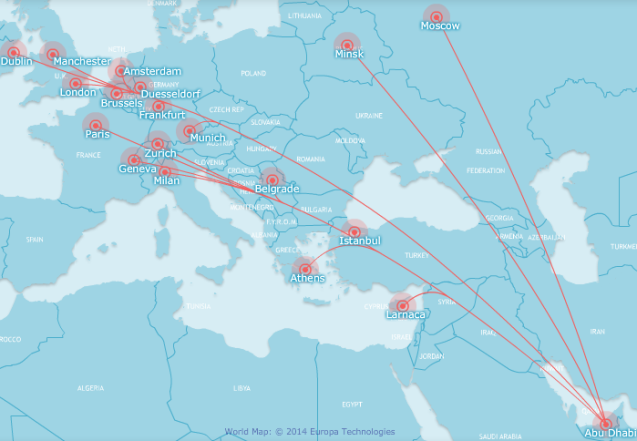

Source: Innovata FlightMaps Analytics

In some cases the links with strong expatriate communities – such as Ireland and Greece – add to the value of smaller EU countries it has teamed with.

Etihad’s next European route will be the launch of services to Zurich in Switzerland at the start of June. The new route ties with another of its European ventures, the former Darwin Airline operation, which began flying under the Etihad Regional banner at the start of the year. “What Etihad Regional gives us is the ability to connect Zurich into our system,” says Hogan.

Switzerland is one of several key non-EU countries in Europe it has also secured codeshare partners which include Russia, Turkey and the Ukraine, as well as its equity investment in Air Serbia.

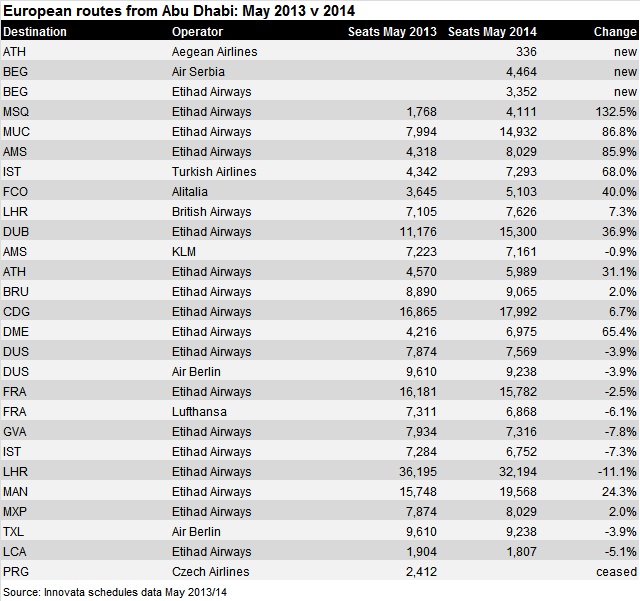

Etihad’s partnership strategy has also brought new flights from its codeshare partners into Abu Dhabi. On top of the new Air Europa flights, Latvia’s Air Baltic launched a Riga link in December. Aegean Airlines launched its own flights from Athens to Abu Dhabi in March, complementing the Etihad existing service to the Greek capital. Air Berlin will double frequency on its Berlin services to Abu Dhabi this October.

However, not all airlines have followed the trend of flying towards Abu Dhabi. Czech Airlines, for example, axed its Prague-Abu Dhabi service in line with moves to channel its Asian business through new equity partner Korean Air.

All of this has been achieved against the backdrop of Etihad staying unaligned, giving it the freedom to develop codeshares regardless of a carrier’s alliance affiliation. “[It means] all these airlines can work with us,” says Hogan. “If I was in an alliance I probably wouldn’t have 47 codeshares because I wouldn’t be able to work with them all.”

Source: Cirium Dashboard