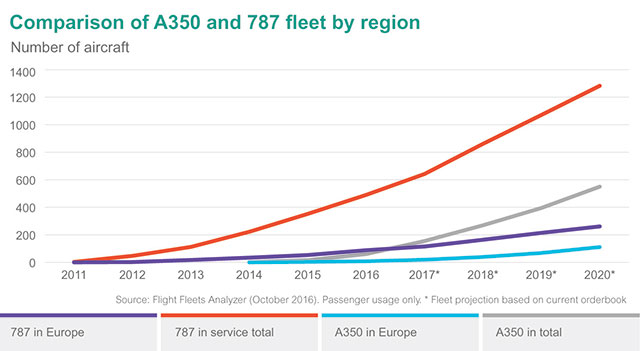

The Boeing 787 and Airbus A350 represent a burgeoning opportunity for Europe’s MRO providers with the region expected to have the world’s second largest fleets of both types by the turn of the decade, based on current order books.

According to Flight Fleets Analyzer there will be almost three times the Dreamliners in service today by 2020. While Europe’s 261-strong fleet will lag that of Asia Pacific – predicted to have 470 787s in service by 2020 – it will surpass North America, at 232, and the Middle East, on 190.

Flight Fleets Analyzer data show the European fleet having grown from two in 2012 and 17 the following year to 88 in 2016. This is expected to grow to 115 next year, 164 in 2018 and 214 in the final year of the decade.

The total 787 fleet, based on current order books, will grow from 490 in 2016 to 1,283 by 2020, passing the 1,000 mark the previous year.

While the A350 only entered service in 2014 and in Europe in 2015, the European fleet is set to reach 111 by 2020, almost 14 times this year’s total of eight. Again this total will be just over half the Asia Pacific fleet, which will have 215 examples of the Airbus twin-jet in operation at the beginning of the 2020s.

The worldwide A350 fleet in 2020 will be 550, growing from 60 this year to 155 in 2017, 269 the following year and 395 in 2019. Again, these figures are based on existing order books.

In Europe, the fleet will increase from just eight in 2016 to 19 next year, 39 in 2018 and 68 in 2019. The 111 figure in 2020 will make Europe’s the second largest fleet, with the Middle East following closely on 103 aircraft and North America, Latin America and Africa trailing with 64, 37 and 20 aircraft, respectively.

Flight Fleet Forecast – a separate independent outlook of the commercial fleet by Flight Ascend Consultancy – predicts 331 deliveries of 787s in Europe between 2016 and 2035, on top of the 53 delivered to 2015. However, Flight Ascend Consultancy expects global Dreamliner deliveries over the 20-year period to total just under 2,700, with almost half the demand coming from China and Asia Pacific.

With 15 of the Airbus widebodies delivered by 2015, the same forecast reckons on 2,068 A350 deliveries over the 20 years to 2035, with 415 in Europe and a total of 880 in Asia-Pacific and China.

The rival widebodies compete closely, although the three-type 787 range straddles segments between Toulouse’s A330/A330neo and its A350-900, while the larger A350 model, the A350-1000, nudges into territory occupied by Boeing’s larger twinjets, the 777/777X families.

The 787-8, which entered service in 2011, seats around 242 passengers, while the 787-9, which has been in service since 2104, accommodates some 280. The 787-10 is expected to enter service in 2018. Only the smaller variant of the A350, which seats around 315 passengers and was certificated in 2014, is in operation. The A350-1000 is due to join it in service next year.

The data in Flight Fleets Analyzer helps MRO businesses and OEMs quickly and accurately identify business development opportunities and gain an unparalleled understanding of the global fleet.

Source: FlightGlobal.com