Boeing’s quality-control and safety protocols have been thrust back into the spotlight following the early January in-flight failure of a 737 Max 9’s door plug, with regulators, investigators and lawmakers launching fresh probes into the company’s persistent troubles.

Just how the latest problem will impact Boeing remains unclear, but at the very least it seems likely to affect 737 production and delivery rates in the near term. Some analysts also predict management changes on the back of the incident.

If nothing else, the issue further tarnishes Boeing’s reputation as it fights to regain market share lost to Airbus.

More broadly, the 5 January Alaska Airlines incident makes clear Boeing’s quality troubles persist despite executives repeatedly insisting in recent years they had taken steps to bolster safety and resolve quality lapses.

“New CEO. Period,” says Richard Aboulafia, managing director with consultancy AeroDynamic Advisory when asked what is required to reverse the airframer’s fortunes. He thinks Boeing’s troubles have persisted long enough under the tenure of chief executive David Calhoun, the former board chair who took over in 2019 with the express goal of helping Boeing overcome the initial 737 Max crisis.

That opinion is not universal. Another analyst, Michel Merluzeau with AIR, thinks sacking Calhoun would be little but symbolic, and possibly counter-productive.

“It’s a simplified answer to a very complex problem. I think we need to be a little bit patient and not to rush into excessive finger pointing,” Merluzeau says.

He notes that the exact cause of the Alaska incident remains unclear and that Calhoun seemed genuinely shaken by the event and equally determined to fix Boeing’s ailments.

Management changes within Boeing Commercial Airplanes (BCA) are more likely, Merluzeau believes. “I don’t think that the current [commercial aircraft] leadership will remain intact post-Max 9 events.”

BCA is led by Stan Deal, who took over the job in 2019, during the first 737 Max crisis, from Kevin McAllister.

The 737 Max became Boeing’s biggest problem after crashes in October 2018 and March 2019, which killed 346 people.

Investigators attributed the tragedies to a poorly designed flight-control system that pushed both aircraft into dives from which the pilots could not recover. Reports also cited pilot errors and maintenance shortcomings. The FAA grounded all 737 Max aircraft for 20 months until Boeing addressed the flight-control issue.

That grounding should have been a catalyst for change in culture and practice. Since then, Boeing executives have repeatedly stressed a renewed dedication to quality and safety, pointing to structural changes, new safety programmes, and technology investments as evidence that the firm was doing everything necessary to fix its lingering problems.

Boeing created the new role of chief aerospace safety officer, held since the start by longtime executive and engineer Michael Delaney, and formed a new board-level panel – the Aerospace Safety Committee. Boeing also made engineers throughout the company report to a chief engineer rather than to business leaders. Other safety enhancements cited by the airframer include new digital and analytical tools, improved communication with customers, new workshops and training programmes, increased employee engagement, and a safety risk management evaluation with a major airline.

Yet quality issues keep cropping up, both with the 737 Max and other models, notably the 787, hitting Boeing’s ability to meet delivery goals. In August last year, news broke that 737 Max aft-pressure bulkheads supplied by Wichita’s Spirit AeroSystems had miss-drilled holes, requiring Boeing to inspect thousands of holes in about 165 jets. As 2023 ended, news broke that Boeing was urging airlines to inspect 737 Max rudder equipment for loose bolts.

Not all the fault can be laid at Boeing’s door – supplier Spirit AeroSystems produces several affected parts – but the airframer’s systems did not pick up on some issues until hundreds of aircraft had been assembled.

Such problems were significant. But at least they were caught before something terrible happened.

Everything changed on 5 January when the Alaska Max 9’s emergency door plug blew out at around 16,000ft, leaving a gaping hole in the side of the jet. The rapid decompression reportedly ripped the shirt off one passenger.

To some extent, the incident had a happy ending: the pilots landed flight 1282 safely in Portland without serious injuries to anyone onboard.

But had the narrowbody been cruising at 30,000ft the outcome could have been so much worse.

Which is why flight 1282 lit a candle under the Federal Aviation Administration (FAA), airlines and legislators. Alaska quickly grounded its Max 9s, and the FAA followed with an emergency airworthiness directive grounding 171 Max 9s globally – all with those same door plugs – pending inspections.

The FAA says the grounding will remain in effect until it approves “an inspection and maintenance process that satisfies all FAA safety requirements.”

It has not predicted when the grounded jets might return to the skies, saying safety will dictate the process. The agency said on 17 January that inspections of 40 door plugs have been completed.

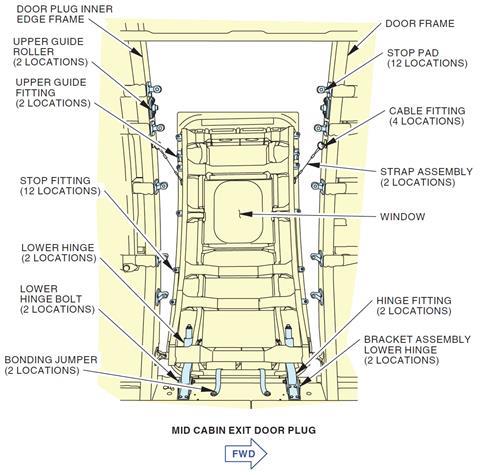

The failed plug covered an unused mid-cabin emergency exit door. While Max 9s can carry up to 220 passengers, Alaska outfits its jets with only 178 seats, meaning it does not need mid-cabin exits under FAA regulations. Other airlines also plug that particular exit.

Four bolts keep the door plugs in place, or are meant to. Early indications suggest the incident resulted from a problem with the plug or its fixings which was inherent at the aircraft’s delivery in late October 2023.

Following the 5 January incident, United Airlines reported finding loose door-plug hardware during inspections.

Experts say circumstances point to a manufacturing or quality issue, either with Boeing or a supplier. Spirit supplies the plugs with the 737 fuselages it also builds, and Spirit makes the plugs in Malaysia, the NTSB says. Neither Spirit nor Boeing have revealed details about the part.

Former National Transportation Safety Board (NTSB) member John Goglia, now an aviation safety consultant, sees several potential scenarios as causing the incident. For example, the hardware could have been insufficiently tightened by the supplier. Equally, Boeing workers could have removed the plug as part of the final assembly process and failed to re-tighten the crucial bolts sufficiently.

Regardless of the underlying cause, “It would appear that Boeing needs to seriously increase the number of inspections of the installation of various [parts] on their airplanes,” Goglia says.

Investigations by the FAA and NTSB are now underway. Lawmakers are also demanding answers.

The FAA says its investigation is focused on Boeing’s manufacturing, testing and quality assurance processes, and those of Spirit. The agency is evaluating Boeing for “alleged non-compliance” with aircraft inspection and testing regulations and is reviewing the “delegated authority” under which Boeing and other aerospace manufacturers enjoy a large degree of self-regulation.

“The FAA is… bolstering its oversight of Boeing, and examining potential system change,” the agency says.

Since 5 January, CEO Calhoun has promised full transparency. He says the company will be “acknowledging our mistake” and giving its full support to investigators.

In contrast, during the early part of the first 737 Max crisis, the manufacturer was perceived as being less than transparent and pressuring the FAA to lift the type’s grounding.

“When I got that picture… I didn’t know what happened to whoever was supposed to be in that seat next to that hole in the airplane,” Calhoun said during a 9 January all-hands company meeting, referring to images taken from inside the Alaska jet. The event “shook him to the bone”, he added.

Boeing on 16 January said it hired former US Navy admiral Kirkland Donald to lead an “in-depth assessment” of its quality management system. Donald will also be a special advisor to Calhoun.

Analysts predict Boeing and the Max will recover, noting the grounding affects a small subset of the overall Max fleet. But larger questions, such as how additional scrutiny by regulators will impact the company, and what investigators may find, remain unanswered.

“It’s just a question of what it means for additional oversight. It’s really the knock-on effect,” says Aboulafia.

Meanwhile, the company remains locked in a competitive battle with Airbus, and analysts already view Boeing as struggling to keep pace with its European rival.

In recent weeks, both companies released full-year 2023 order and delivery figures and, for the fifth year running, Airbus led Boeing in both metrics.

True, Boeing enjoys strong demand for 787s, which Aboulafia calls the industry’s “leading widebody”.

But Airbus continues to pull ahead in the narrowbody war. It ended 2023 holding unfilled orders for 7,197 A320neo-family jets, including for a whopping 4,923 A321neos – more of that variant alone than the 4,332 orders Boeing holds for all 737 Max variants.

Boeing badly needs get its 737 Max 10 – which most-closely matches the A321neo – into customers’ hands, but the variant’s certification programme remains ongoing and beset by delays. Under the company’s latest timeline, deliveries are set to begin in 2025.

“It’s good to be Airbus,” says Aboulafia. “They have leadership. They have a product-development road-map and they are winning the market-share war.”

Boeing badly needs to boost 737 production to keep pace. In 2023, it hit a 31-per-month rate on the narrowbody and has said it intends to hit 50 per month by 2025 or 2026. But the new Max 9 problem, the new quality reviews and the fresh inquiries will not make that task any easier.

“You cannot [increase production] without increased automation and better quality control,” says Merluzeau.

Goglia wonders if the FAA should even allow more rate hikes: “If I were the FAA , I’d say, ‘Show me when you can produce six months of airplanes with minimal quality problems, and then we will talk about it,’” he says.