Sixth-generation jets, UCAVs, and counter-UAS systems are among the solutions nations are turning to in their quest for air superiority over rivals. EDGE is playing a major role in delivering key technologies

The latest, sixth generation of fighter jets, due to enter service by 2040, will redefine the concept of air superiority. The likes of the Boeing F-47, under development for the US Air Force, the UK/Italian/Japanese Global Combat Air Programme (GCAP), and the Franco-German Future Combat Air System (FCAS) will feature advanced stealth and artificial intelligence-powered threat analysis and be capable of real-time data exchange with other aircraft and ground stations.

Beyond the West, China, with its J-XX, and Russia, with the Sukhoi Su-25 Checkmate – revealed at the Dubai Airshow in 2021 – have their own advanced combat aircraft projects in the works, signaling that the drive for air dominance, in a future conflict or as a deterrence, remains a major objective for all the big powers. With almost all these programmes, the intention will be that partner nations come in as industrial participants and customers.

Although the sixth-generation types are almost certain be flown with a pilot on board – at least in their initial iterations – all are designed to operate as part of a wider network of piloted and uncrewed assets that uses AI and autonomous systems to speed decision making. Those technologies, together with the emergence of ever more sophisticated and capable drones, are set to transform combat tactics and the way armed forces achieve air superiority.

While Top Gun fighter pilots are still likely to be in demand for many decades to come, autonomy has become decisive in the race for dominance in the skies, with Fortune Business Insights forecasting that the global autonomous aircraft market will triple in size to more than $22 billion by the end of the decade, propelled by AI-enabled mission systems, the need for value-for-money operations, and the ability to achieve force projection while reducing risks to pilots in contested environments.

Uncrewed air vehicles (UAVs) are becoming ever more relevant in the air domain as force multipliers, and AI is set to enhance their capabilities further, according to Hamad Al Marar, managing director and CEO of EDGE, who notes that the UAE – through EDGE predecessor companies – was “an early adopter” of drone technologies in the early part of the century. “They play a role in both air defence and intelligence. Autonomy has always been a driver for us,” he says.

Autonomous assets are these days able to offer commanders a series of options when it comes to achieving air superiority. While uncrewed combat air vehicles (UCAVs) able to operate with minimal human intervention are still on trial, there have been huge advances in the capability of surveillance drones, counter-UAS systems, and so-called loyal wingmen programmes. These are AI-controlled unmanned aircraft able to operate alongside piloted jets in electronic warfare, decoy, and air defence suppression roles.

The best-known example of a loyal wingman platform – or collaborative combat aircraft (CCA) – is the Boeing MQ-28 Ghost Bat. Developed by Boeing in Australia for the Royal Australian Air Force – and the first type designed in the country since the Second World War – the MQ-28 has accumulated more than 150h of flight time since taking to the skies in 2021. Trials have included establishing data links with a Boeing E-7A Wedgetail airborne early warning and control aircraft and operating in concert with multiple aircraft.

While EDGE does not have a purpose-built CCA in its portfolio, the ADASI JENIAH UCAV can perform many loyal wingman duties, such as suppressing enemy air defences and providing critical precision strike capabilities across land and sea. Unveiled in prototype form at the IDEX defence fair in Abu Dhabi early this year, the fully autonomous, low observable, less than 4t maximum take-off platform cruises at Mach 0.7 and can deliver payloads of up to 480kg.

TACTICAL INTELLIGENCE

ADASI’s medium-altitude, long-endurance (MALE) REACH-S is another example of an asset equipped for an air superiority role. The 120kg payload, fixed-wing UAV is designed for tactical intelligence, surveillance, and reconnaissance (ISR) and light ground attack operations, can take off and land autonomously, and has a 200km range. A sister platform, the compact JERNAS-M, has many of the same capabilities, and can carry payloads of up to 100kg.

While EDGE has developed more than a dozen UAV and UCAV platforms in house, it is also working with overseas partners on programmes in the air dominance and aerial intelligence segments. One of the most notable is its tie-up with US-based Anduril Industries, announced on the first day of this year’s Dubai Airshow. Under a joint venture, the two companies will develop a medium-sized, vertical take-off and landing (VTOL) autonomous air vehicle called Omen.

Anduril’s proven Lattice command-and-control architecture will enable the aircraft, which will be part-designed and manufactured in the UAE, to operate on autonomous, collaborative missions. According to EDGE, Omen will offer the speed, endurance, and autonomous performance of larger, fixed-wing platforms in VTOL format, able to operate independently of runways. The two companies will work together to develop a series of payloads.

The joint venture with California-based Anduril – the first of its kind between EDGE and a major US contractor – shows how the UAE company is now regarded as a peer of some of the world’s leading defence players. “There is no longer a major gap in terms of technologies,” says Khaled Al Zaabi, president of EDGE’s Platforms & Systems cluster. “We have advanced solutions in HALE [high-altitude, long-endurance] and MALE. In many instances, we can offer the same mission capabilities [as US or European manufacturers], but at a fraction of the price.”

While offensive assets are a vital part of achieving aerial superiority in any conflict, equally crucial is networked, integrated air defence – directed energy weapons, interceptors, and other sensor technologies to counter threats from mortars to loitering munitions or so-called kamikaze drones and hypersonic missiles. One of EDGE’s most significant contributions in this field is its alliance with Rheinmetall on the Skynex short-range air defence system.

Under a partnership announced at IDEX in 2023 with the German firm’s subsidiary Rheinmetall Air Defence in Switzerland, EDGE unit HALCON is supplying the system’s missiles, with SKYKNIGHT. The multi-target, short-range air defence weapon is the first counter-missile, counter-UAV, and counter-rocket, artillery, and mortar (C-RAM) designed in the UAE. Four missile launch units can intercept up to 80 targets simultaneously. The SKYKNIGHT development is nearing completion. “We are putting a lot of effort into getting it to the end of its maturity cycle with 70% of the development complete,” says Saif Al Dahbashi, president of EDGE’s Missiles & Weapons cluster. While EDGE has complete design authority and manufacturing responsibility for the missile, it is cooperating with Rheinmetall on the control nodes and multi-sensor unit. “We are involved with the programme across the board,” he says.

According to Al Dahbashi, nations are increasingly looking at having a full array of air defence solutions. While Raytheon dominates the top of the market with the Patriot anti-ballistic missile system, “layers are important” when dealing with a range of threats. This means identifying them and choosing the correct response – which may involve disrupting, jamming, or redirecting a missile instead of destroying it. And while this process has traditionally been manual, AI will speed decision making when minutes and even seconds are crucial.

Powering up

EDGE entity EPI is today a highly respected supplier of build-to-print aerostructures, mostly for commercial airliners – its products include components for the Boeing 777X’s vertical stabiliser and engine pylons for the Airbus A320.

“Today, we’re an airframer that happens to make turbo machinery components. Tomorrow, we will be a turbo machinery company that happens to make aerospace components.”

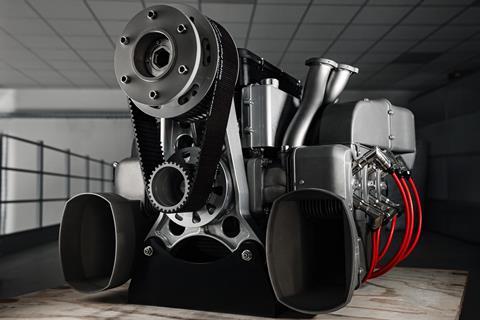

That is the bold claim of EPI CEO, Michael Deshaies. Bold, because the engines he refers to – from EDGE’s newest offshoot, POWERTECH, a neighbour in Abu Dhabi’s Tawazun Industrial Park – are still some way off volume production.

However, as Deshaies points to blueprints for a new kilometre-long engine production complex adjoining EPI’s current manufacturing plant, there is no doubt of EDGE’s ambition to become the largest manufacturer of propulsion systems for uncrewed air systems (UAS) in the next few years.

Its aspirations are driven by need. EDGE is a major producer of UAS and missiles and wants to be an even bigger player. Thus far, its products have been powered by engines sourced off the shelf. But supply chain snags have made the market less reliable – hence EDGE’s decision to rapidly invest in in-house capability.

And despite POWERTECH’s early products still being at the development stage, scale-up is expected to be swift, with POWERTECH’s CEO Marian Lubieniecki anticipating the launch of output next year.

“We’d originally earmarked 2027 for production, but decided to shorten the timeline by one year,” he says. “We are now aiming to be ramping up production in the middle of next year, with full-scale production in 2027.”

By then, POWERTECH is aiming for an initial annual output of between 1,000 and 2,000 microjet engines – ranging in thrust from 400 N to 1,200 N – as well as “a couple of hundred” pistons for powering small to mid-size drones. “It might be more, but that’s our initial target,” says Lubieniecki.

While EPI is new to engine manufacturing – which often involves precision rotating parts made of superalloys rather than the rigid titanium and aluminium components common in aerostructures – Deshaies is confident EDGE has the skills and machinery for the job.

It has invested heavily in state-of-the-art seven- and nine-axis milling and turning machines, as well as creating a “propulsion manufacturing innovation centre” to prepare for what Deshaies calls a “massive development to handle propulsion manufacturing.”

Lubieniecki says POWERTECH has three guiding objectives: to produce propulsion systems that fit the customer’s requirements, to help the UAE achieve national sovereignty in propulsion manufacturing, and to create a sustainable, long-term business.

“All the pieces of the puzzle are in place,” he says. “We have the resources to mass produce, and we need to start as soon as possible. We don’t have the luxury of waiting until the end of the decade, because someone else will eat our lunch.”

Maintaining an EDGE

The UAE defence house’s innovative, disruptive and affordable technologies are helping equip customers with the assets they need to protect their national security, as more industry players around the world line up to be part of the six-year-old group’s success, says its CEO

- 1

Currently

reading

Currently

reading

Dominating the skies

- 3

- 4

- 5

- 6