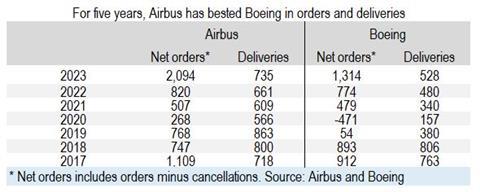

For the fifth consecutive year, Airbus in 2023 delivered more aircraft and landed more orders than Boeing, reflecting the US company’s ongoing difficultly in overcoming troubles with its aircraft programmes, most notably with the 737 Max.

Boeing last year did make strides, landing significant new 737 orders and impressive deals for the 787 – a type that enjoyed a resurgence last year as airlines started again planning for long-haul growth.

But the US airframer’s operational struggles continued as more issues with the 737 Max emerged, a point starkly illustrated in the opening days of 2024 when a door plug blew out of a Max 9 during flight, forcing regulators to ground hundreds of the type.

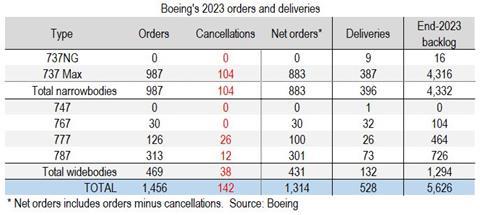

Boeing closed 2023 having landed new orders for 1,456 aircraft, though customers also cancelled deals for 142 jets, taking the net figure to 1,314 units, the airframer’s data shows.

Those net new orders included 883 737 Max, 30 767-based KC-46 aerial refuelling tankers, 100 777s and 301 of the strong-selling 787.

Customers placing large 737 Max orders last year included Southwest Airlines (orders for 111), Ryanair (150) and Air India (190).

In December alone, Boeing padded its backlog with new orders for 371 jets, including 301 737 Max, as customers such as Lufthansa, Avolon, SunExpress and Ethiopian Airlines signed for dozens of the narrowbodies. December was also another strong month for the 787, with the manufacturer taking new orders from unnamed customers for 68 of the type.

Boeing’s 777X programme had surged in November after Emirates Airline ordered 90 of the type, including 55 777-9s and 35 777-8s, bring the Gulf carrier’s total commitment for the widebody twin to 205 aircraft.

But Airbus bested Boeing’s 2023 performance, landing 2,319 gross orders, with 225 cancellations reducing the net total to 2,094 aircraft. The figure was also ahead of the European airframer’s 2022 total, when it booked net orders for 820 aircraft.

Airbus chief executive Guillaume Faury calls 2023 “a landmark year for Airbus’ commercial aircraft business, with exceptional sales and deliveries on the upper end of our target”.

“A number of factors came together to help us achieve our goals, including the increased flexibility and capability of our global industrial system, as well as the strong demand from airlines to refresh their fleets,” he adds.

The Toulouse-headquartered manufacturer’s net orders last year included deals for 141 A220s and, impressively, for 1,675 A320-family jets.

Airbus ended 2023 on a particularly high note, landing December deals for 807 jets, including for 521 A321neos. EasyJet, Turkish Airlines and Avolon each placed 100-plus-strong A321neo orders in the final month of the year.

Faury describes demand for widebody jets as healthier in 2023, saying that sector’s recovery came “much sooner than we expected”.

The A350 was a hot seller, with Airbus landing net orders for 281 of the type last year, up from just 10 in 2022. Customers including Air France-KLM, Air India, Emirates, Eva Air, International Airlines Group, Qantas and Turkish placed commitments for substantial numbers of the widebody twin last year.

Both Airbus and Boeing have struggled in recent years to overcome supply chain and labour shortages – issues that have afflicted companies throughout the aerospace industry. The problems have particularly affected production of engines and have hindered the ability of both airframers to boost output.

But Airbus seems to be faring better than Boeing. The European manufacturer delivered 735 aircraft last year – up from 661 in 2022 – including 68 A220s, 571 A320neo-family jets, 32 A330s and 64 A350s. It ended 2023 with an 8,598-strong backlog: 600 A220s, 7,197 A320-family aircraft, 180 A330s and 621 A350s.

Boeing meanwhile, struggled throughout 2023 with production and quality problems that slowed deliveries. It ended the year having shipped 528 aircraft, broadly in line with its target and up against 480 in 2022, but still lagging its rival significantly.

At the start of 2023, Boeing had aimed to deliver 400-450 737s during the year. But in October it reset the target to 375-400 deliveries, citing a quality problem involving mis-drilled holes in 737 aft-pressure bulkheads supplied by Spirit AeroSystems.

Boeing closed December with 396 737s handed over – including 387 737 Max and nine 737NG-based P-8 maritime patrol aircraft – just a hair better than the 387 737 shipments it made in 2022.

But Boeing did manage to significantly hike its widebody deliveries last year, handing over 132 of those jets, against 93 teh previous year. Shipments including one 747 – the programme’s final example – 32 767s, 26 777s and 73 787s.

The US company closed 2023 with 5,626 aircraft in its backlog, among them 4,332 737s, 104 767s, 464 777s and 726 787s.

All through last year Boeing executives insisted they were addressing nagging quality problems, but recent events suggest its ship continues to list. In late December, while still dealing with the 737 aft-pressure bulkhead issue, news broke that Boeing was urging customers to inspect 737 Max for loose bolts in rudder assemblies.

Then on 5 January an emergency exit door plug on an Alaska Airlines 737 Max 9 blew out during flight, causing immediate depressurisation of the narrowbody. The pilots diverted to Portland and no passengers or crew were seriously injured, but the Federal Aviation Administration (FAA) responded promptly by grounding 171 737 Max 9s with the same door plugs.

As part of its inquiry, the FAA is investigating Boeing for “alleged non-compliance” with regulations related to inspection and testing of new aircraft.

Additionally, at least two airlines – Alaska and United Airlines – have reported finding loose door-plug hardware during inspections.

The degree to which the door-plug issue will impact Boeing’s 2024 orders and deliveries remains unclear. While analysts have predicted minimal long-term impact, the fallout continues to spread and has sparked broader concern about Boeing’s ability to consistently deliver problem-free aircraft.

The FAA – itself under immense pressure to avoid missteps – has insisted it will not lift the latest grounding until receiving and reviewing more data about the door-plug issue from Boeing. Other inquiries are underway by US lawmakers and the National Transportation Safety Board.

Boeing, meanwhile, insists it will fix quality shortcomings. Last week, chief executive David Calhoun said his team will ensure “every airplane that Boeing has its name on that’s in the sky is in fact safe”.