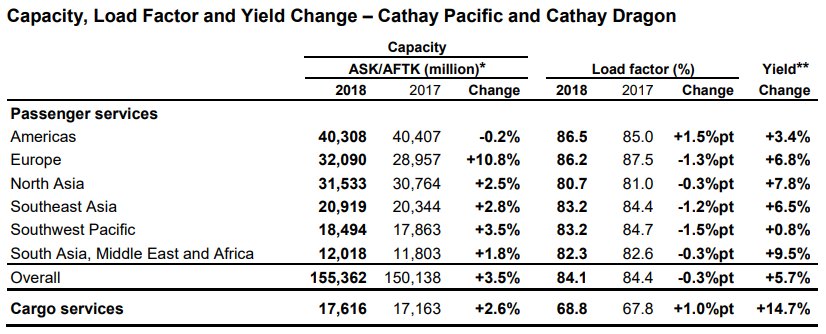

Cathay Pacific and Cathay Dragon saw yields across their network rise in 2018, a solid improvement from 2017 when yields were down across all its passenger services markets.

Overall, the duo raised ASKs by 3.5% during the year with the introduction of new routes and increased frequencies, resulting in a 0.3 point drop in load factor to 84.1%. Yield however climbed 6.7% to 55.8 Hong Kong cents ($0.13), due to improved demand in premium class, fuel surcharges and revenue management initiatives.

Cathay Pacific

South Asia, Middle East and Africa saw the largest yield jump at 9.5%, as it put on 1.8% more capacity. Demand on Middle East routes was strong, reflecting robust bookings from mainland China and Japan, says the airline.

Yields on services to North Asia meanwhile climbed 7.8%, as passenger traffic grew faster than capacity increases on mainland China routes, and with strong demand to Japan.

Another bright spot on its network was Europe, where yields shot up 6.8%, even with a 10.8% capacity increase. This, Cathay says, reflects the strong demand for its premium classes.

Southeast Asia meanwhile saw yields climb 6.5%, as the carrier focused more on individual passengers rather than group traffic, and improved revenue management.

There was also robust demand on services to the Americas, resulting in a 3.4% yield jump. It is however the only market where Cathay reduced capacity, albeit just by 0.2%. Besides strong demand out of North America, there was also strong premium class demand to the continent, says Cathay.

Its cargo business was even more positive, with a 14.7% jump in yields as capacity climbed 2.6%. Load factor climbed one point to 68.8%.

Source: FlightGlobal.com